In 2025, small businesses are no longer limited by size, but by the tools they use. While ambition remains high, the challenge often lies in managing resources efficiently—especially when it comes to accounting. Gone are the days of ledgers, spreadsheets, and manual billing. The business landscape is changing fast, and so should your accounting methods. This is where smart accounting software comes into play and Game-Changer.

Whether you run a retail shop, a freelancer business, a startup, or a small manufacturing unit, adopting a smart accounting software in 2025 isn’t just a luxury—it’s a necessity.

The Shift from Traditional to Digital Accounting

Traditionally, small businesses managed their accounts manually—either through physical ledgers or Excel sheets. While this worked in the past, it now creates unnecessary burdens and Game-Changer:

- Time-consuming entries

- Manual calculation errors

- Missing records

- Unorganized billing and receipts

- Difficulty in filing taxes on time

In today’s fast-paced environment, where businesses are increasingly going digital, manual accounting leads to delays, confusion, and often, compliance issues. Smart accounting software eliminates all of this by automating, organizing, and streamlining your entire financial process.

Key Challenges Faced by Small Businesses Without a Smart Accounting System

Before diving into the benefits, let’s take a look at some of the most common problems faced by small business owners who still rely on manual or outdated accounting tools:

- Data Loss or Damage: Paper records can be lost, damaged, or stolen.

- No Real-time Financial View: You don’t know your current cash flow, pending invoices, or expenses.

- Tax Filing Hassles: GST filing, reconciliation, and reporting are complex without automation.

- Time-Consuming: You or your accountant spends too much time on repetitive tasks.

- Limited Scalability: As your business grows, manual systems simply can’t keep up.

The result? Missed opportunities, late payments, compliance risks, and loss of credibility.

What is Smart Accounting Software?

Smart accounting software is more than just a digital ledger. It is a complete business finance management solution that offers features like:

- Automated invoicing

- GST-ready reports

- Expense tracking

- Bank account integration

- Real-time dashboard for income & expense

- Cloud-based data backup

- Multi-user access with permission control

Some smart software even come with mobile apps, enabling business owners to manage accounts anytime, anywhere.

Why 2025 is the Right Time to Switch

With increased GST regulations, digital payments, e-invoicing, and government focus on compliance, 2025 demands transparency and speed in accounting. Customers expect quick invoices and clear transactions. The Income Tax Department expects timely reporting. You can’t afford delays or manual errors anymore.

Additionally, the cost of technology has significantly reduced, making even the most powerful accounting software affordable for small businesses. This makes 2025 the perfect year to upgrade your systems.

Top Benefits of Using Smart Accounting Software

1. Save Time, Increase Efficiency

Automated processes like invoice creation, recurring bills, and GST calculations save hours of manual effort every week. This gives you more time to focus on business growth.

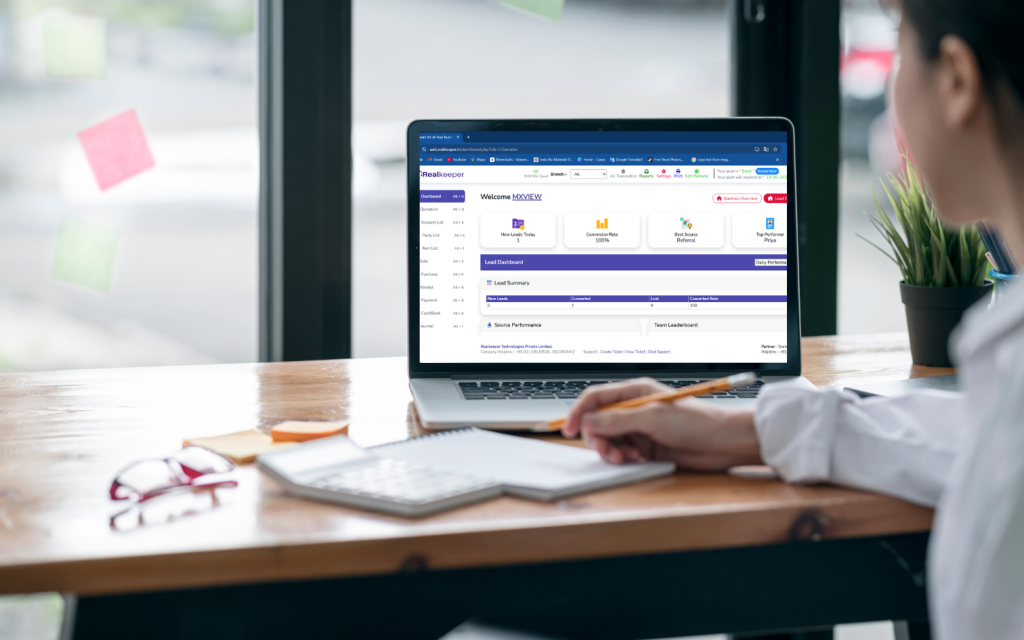

2. Make Informed Decisions with Real-Time Reports

With live dashboards, you can track your income, expenses, profits, outstanding dues, and more—anytime. This helps you take quick and smart decisions instead of relying on monthly reports from an accountant.

3. Easier GST Filing & Tax Compliance

Smart software auto-generates GST reports like GSTR-1, GSTR-3B, etc., and even helps in reconciling returns. This reduces last-minute rush and errors during filing.

4. Professional Invoicing & Branding

Send branded, professional invoices via email or WhatsApp directly from the app. You can even add payment links and QR codes for faster payments.

5. Track Expenses Like a Pro

Every rupee spent can be tracked. Upload receipts, categorize spending, and control costs effectively.

6. Data Security & Cloud Backup

Smart software stores data securely on cloud servers with automatic backups. You never lose your financial records—even if your phone or laptop crashes.

7. Multi-User Access

Assign roles to your accountant, manager, or staff with limited permissions. No need to share passwords or give full access to sensitive data.

8. Manage Business on the Go

With mobile-friendly apps, you can check your income, pending dues, or send invoices while travelling, sitting at home, or from your shop counter.

Real Use Case: How a Kirana Shop Transformed with Accounting Software

Take the example of Mr. Rajesh, a local grocery store owner in Jaipur. Before 2024, he managed accounts in a diary and Excel. His biggest pain points were:

- Forgetting to collect payments from credit customers

- Delays in monthly stock and profit calculation

- Manual GST filing every quarter

After shifting to a smart accounting app, he automated customer billing, tracked credit sales, and generated GST reports in a click. Within 6 months, his profits increased by 15%—not because he earned more, but because he tracked better and spent smarter.

How to Choose the Right Software for Your Business

Not all accounting software are created equal. While there are many options, you should choose one that matches your business type and comfort level.

Key things to consider:

- Is it easy to use even for non-accountants?

- Does it support GST, invoice customization, and expense tracking?

- Can you use it on mobile?

- Is customer support available in your local language?

- Is your data safe and backed up?

Look for a tool that is simple, secure, and built for Indian small businesses.

Accounting Software is Not Just for Accountants – It’s for Business Owners

A major myth among small business owners is that “accounting is only for accountants.” But in the new business era, entrepreneurs must know where their money is going, how much profit they are making, and what actions they need to take. Smart accounting tools empower business owners, not replace accountants.

When you understand your numbers, you control your business.

Conclusion: Upgrade Today, Grow Tomorrow

In 2025, being small is no excuse for being outdated. Whether you’re a small trader, freelancer, shop owner, or service provider, using smart accounting software is the foundation of modern business success. It saves time, reduces errors, boosts your brand image, and helps you grow with confidence.

Don’t wait for a tax notice or a missed payment to wake you up.

Go smart today. Let your accounts work for you, not against you.