In today’s fast-changing business world, financial management is no longer just about keeping records. It’s about making smarter decisions with real-time data, expense tracking, and automated accounting systems. For small and medium businesses, managing accounts manually or using outdated methods often leads to errors, delays, and even financial losses.

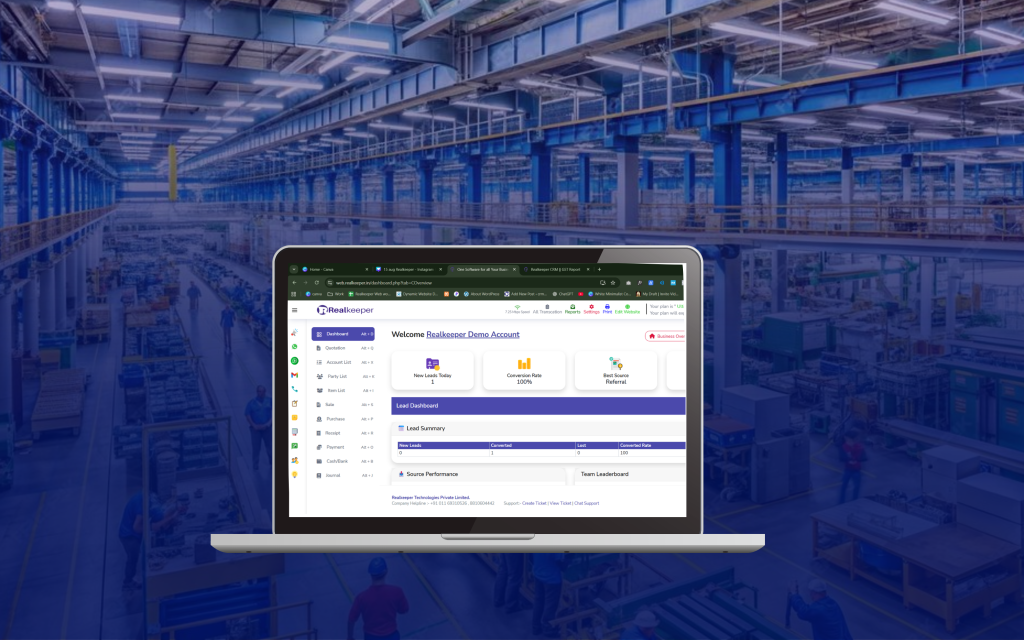

That’s where RealKeeper Accounting Software comes in. Designed with the modern entrepreneur in mind, RealKeeper offers smart accounting and expense tracking solutions that help businesses stay profitable, efficient, and future-ready in 2025.

In this blog, we’ll explore why smart accounting & expense tracking is the backbone of successful businesses today and how RealKeeper makes the entire process simple, secure, and profitable.

Why Smart Accounting Matters in 2025

The year 2025 marks a turning point in how businesses handle their finances. With digital transformation, automation, and AI-driven insights, companies are moving away from traditional accounting practices.

Here’s why smart accounting has become essential:

- Time-Saving Automation – Businesses can no longer waste hours on manual data entry. Automation reduces errors and saves time.

- Real-Time Expense Tracking – Tracking income and expenses instantly helps business owners make better financial decisions.

- GST & Compliance – Smart software ensures accuracy in tax filing and compliance.

- Cost Control – By analyzing expense patterns, businesses can cut unnecessary costs and maximize profits.

- Scalability – As businesses grow, they need software that can handle increasing data without extra complexity.

RealKeeper combines all these needs into one easy-to-use platform.

The Power of Expense Tracking for Business Profitability

Expense tracking is not just about recording what you spend — it’s about understanding where your money goes and optimizing it for profitability.

Benefits of Expense Tracking:

- Identify unnecessary expenses and eliminate wastage.

- Understand cash flow trends to avoid shortages.

- Track department-wise or project-wise expenses for better budgeting.

- Get tax-ready reports with all expenses categorized.

- Ensure financial discipline across the organization.

When done right, expense tracking ensures that every rupee spent contributes to business growth.

How RealKeeper Simplifies Accounting & Expense Tracking

RealKeeper is not just another accounting software — it’s a complete financial control system. Here’s how it helps businesses stay profitable in 2025:

1. Automated Double-Entry Bookkeeping

No more confusion in ledgers! RealKeeper automatically manages double-entry accounting ensuring accuracy in every transaction.

2. Smart Expense Categorization

From rent and utilities to salaries and travel, RealKeeper automatically categorizes expenses for easy analysis.

3. Real-Time Dashboard

Business owners get a 360° view of income, expenses, and profit in one dashboard. This means no more guessing — decisions are based on data.

4. GST & Tax Compliance

With GST-ready invoices and reports, RealKeeper makes compliance stress-free. Say goodbye to last-minute tax headaches.

5. Bank & Payment Integration

Easily connect your bank accounts and digital payments to record transactions automatically.

6. Secure Cloud Backup

All financial data is stored securely in the cloud with 24/7 access — giving you peace of mind and flexibility.

7. Insightful Reports

Generate profit & loss, balance sheets, cash flow reports, and expense summaries with just a click.

Why Businesses Trust RealKeeper in 2025

RealKeeper has become the go-to choice for SMEs, startups, freelancers, and growing enterprises. Here’s why:

- User-Friendly Interface – Easy for accountants and business owners alike.

- Affordable Plans – Smart accounting doesn’t have to be expensive.

- Scalable Solutions – Whether you’re a freelancer or a 500-employee company, RealKeeper grows with your business.

- 24/7 Accessibility – Work from anywhere with cloud-based access.

Real-Life Example: How Expense Tracking Boosts Profitability

Imagine a retail store spending heavily on logistics without realizing the rising costs. With RealKeeper expense reports, the owner notices delivery expenses have increased by 20% in six months. By switching logistics providers, they save ₹50,000 annually — directly adding to profits.

This is the power of real-time accounting & expense tracking.

Smart Accounting Trends in 2025

As we move forward, here are the trends shaping accounting in 2025:

- Mobile Accounting – Managing accounts directly from smartphones.

- Integrated Payments – Linking accounting with digital payment platforms.

- Data Security – End-to-end encryption and safe cloud storage.

- Eco-Friendly Accounting – Going paperless with 100% digital records.

RealKeeper already integrates these features, making it future-ready.

How RealKeeper Keeps Businesses Profitable

Profitability is not only about increasing sales but also about controlling expenses and maximizing efficiency. RealKeeper ensures profitability by:

- Reducing accounting errors (saving time & penalties)

- Automating repetitive tasks (freeing staff for core work)

- Providing insights for smarter financial decisions

- Helping cut unnecessary costs with detailed expense reports

- Ensuring compliance to avoid tax fines

With these advantages, businesses can focus on growth while RealKeeper handles the finances.

Final Thoughts

In 2025, smart businesses are those that adapt to technology. Accounting & Expense Tracking is no longer optional – it’s the foundation of business success.

With RealKeeper Accounting Software, businesses get:

✔ Smart accounting automation

✔ Real-time expense tracking

✔ Compliance-ready reports

✔ Secure cloud storage

✔ Profitability insights

If you want your business to grow, stay profitable, and remain future-ready, then RealKeeper is your ultimate accounting partner in 2025.