Introduction

Managing your business finances shouldn’t feel like solving a puzzle with missing pieces. Yet for many entrepreneurs and small business owners, that’s exactly what it feels like—spreadsheets here, invoices there, tax documents in another folder, and important financial data spread across multiple apps and platforms.

In 2025, technology has taken a bold leap forward, offering entrepreneurs and financial professionals one powerful dashboard that puts total financial control at their fingertips. With this centralized approach, you can say goodbye to financial guesswork and hello to clarity, automation, and smarter decision-making.

If you’re still juggling Excel sheets, handwritten ledgers, or disconnected tools, it’s time to upgrade to a modern, smarter solution.

2. Why Financial Control Is Crucial in 2025

In today’s fast-moving business world, real-time financial insights are not optional—they’re critical. Every transaction, no matter how small, affects your cash flow, compliance, and profitability. Factors like inflation, digital payment systems, tax regulations, and global economic shifts make it even more important to stay on top of your finances.

Lack of proper financial control often leads to:

- ❌ Missed opportunities due to unclear cash positions

- ❌ Overspending without realizing your budget is off-track

- ❌ Tax penalties because of incorrect or late filings

- ❌ Poor decision-making from incomplete or outdated data

A smart dashboard helps you avoid these pitfalls by bringing all financial data under one roof, giving you instant visibility and control.

3. What Is a Financial Dashboard?

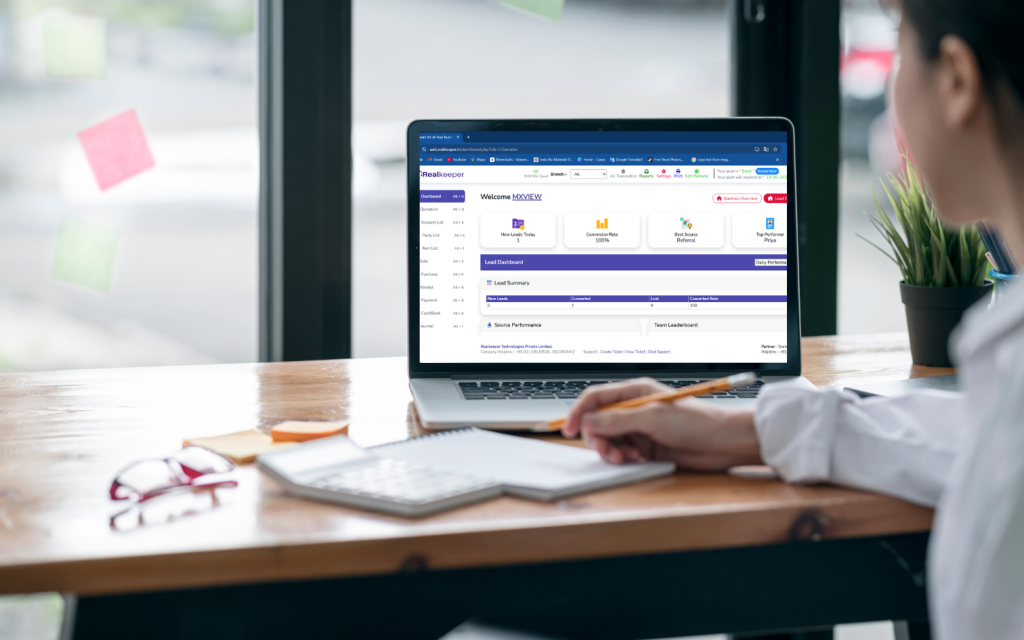

A financial dashboard is a centralized, visual platform that collects, analyzes, and displays your financial information in real time. It simplifies complex data into easy-to-read graphs, summaries, and reports.

With a dashboard, you can quickly view:

- Revenue and expenses

- Profit and loss reports

- GST filings and dues

- Invoice tracking and payment status

- Budget planning and variance

- Customer and vendor balances

In short, it acts as your business’s financial command center, making daily monitoring and long-term planning easier and more accurate.

4. Key Features of a Powerful Financial Dashboard

Not all dashboards offer the same value. In 2025, your financial dashboard should include intelligent features such as:

- ✅ Real-Time Analytics – So you’re always informed about your financial position

- ✅ GST & Tax Automation – Never miss a filing, and reduce compliance risks

- ✅ Cash Flow Forecasting – Predict future income and expenses with accuracy

- ✅ Custom Reports – Generate reports tailored to your industry and stakeholders

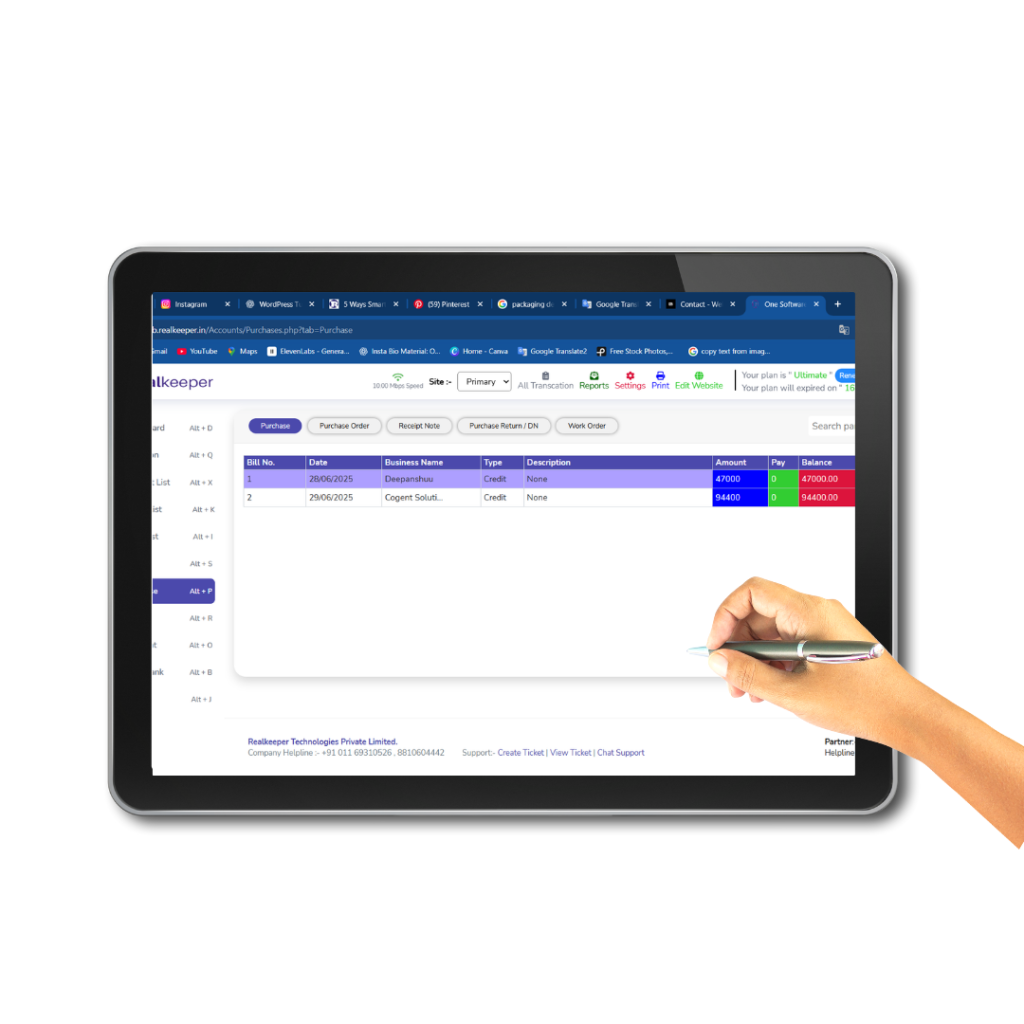

- ✅ Multi-Device Access – Manage your finances on desktop, tablet, or smartphone

- ✅ Data Security – Protect your financial data with advanced encryption and backups

These features save time, reduce errors, and empower you with actionable insights.

5. Benefits of Using an All-in-One Dashboard

A financial dashboard is more than a monitoring tool—it’s a growth engine. Here’s how it benefits your business:

- Saves Time: Automate manual tasks like GST calculation, invoice generation, and expense tracking.

- Improves Accuracy: Minimize the risk of manual entry errors and ensure your data is always correct.

- Boosts Decision-Making: Make informed choices with real-time reports and forecasts.

- Enhances Collaboration: Share reports easily with your accountant, team, or business partners.

- Keeps You Compliant: Stay updated with tax filings, deadlines, and audit readiness.

In essence, it acts like your virtual financial assistant, working round-the-clock to keep your business in check.

6. How Realkeeper Empowers Financial Management

Realkeeper is one of the most reliable dashboard solutions for small businesses, freelancers, and startups in India. It brings complete financial clarity and control in a single, easy-to-use platform.

With Realkeeper, you get:

- ✅ GST-compliant invoicing & automated reports

- ✅ Smart expense tracking and alerts

- ✅ Instant profit & tax summaries

- ✅ Reminders for client & vendor payments

- ✅ Mobile and desktop access anytime, anywhere

Whether you’re running a boutique, a consultancy, or a service business, Realkeeper simplifies your entire accounting and billing process.

7. Real-Life Use Case: Dashboard in Action

Case Study: A Small Retailer in Delhi

Before using Realkeeper, this retailer relied on a manual register for daily sales and spreadsheets for expenses. GST filings were always last-minute, and payment follow-ups were inconsistent. After implementing Realkeeper:

- ⏱️ Saved 20+ hours a month with automated invoicing

- 📉 Reduced tax filing errors by 80%

- 💡 Gained insights into which products had the highest profit margins

- 💰 Achieved 15% cost savings by identifying unnecessary expenses

This transformation wasn’t just about organizing data—it led to real business growth.

8. Future of Financial Control: AI, Automation & Beyond

Financial dashboards in 2025 are powered by AI and machine learning. These advanced tools help you:

- 🔍 Predict cash flow issues before they occur

- ⚠️ Identify abnormal spending patterns instantly

- 📊 Recommend budgets based on your historical data

- 🔗 Integrate seamlessly with CRM systems, e-commerce platforms, and banks

With these intelligent features, Realkeeper becomes more than a tool—it becomes your financial partner, guiding you toward smarter, data-driven growth.

9. Conclusion

In an age where financial errors can cost you time, money, and opportunities, using a powerful, all-in-one financial dashboard is the smartest move you can make. It eliminates chaos, brings clarity, and allows you to focus on what truly matters: growing your business.

With tools like Realkeeper, mastering your finances in 2025 is no longer a dream—it’s a click away.

10. Call to Action

https://realkeeper.in/Ready to take control of your business finances in 2025?

👉 Visit www.realkeeper.in and explore the power of a smart, all-in-one dashboard.

✅ Start your free trial today and take the first step toward financial mastery.