Running a small business has never been easy. From managing daily expenses to handling customer billing and staying compliant with GST regulations, entrepreneurs often find themselves buried under financial tasks. In 2025, however, the way small businesses manage their accounts is rapidly changing. The biggest game-changer? Smart GST Billing & Accounting Software.

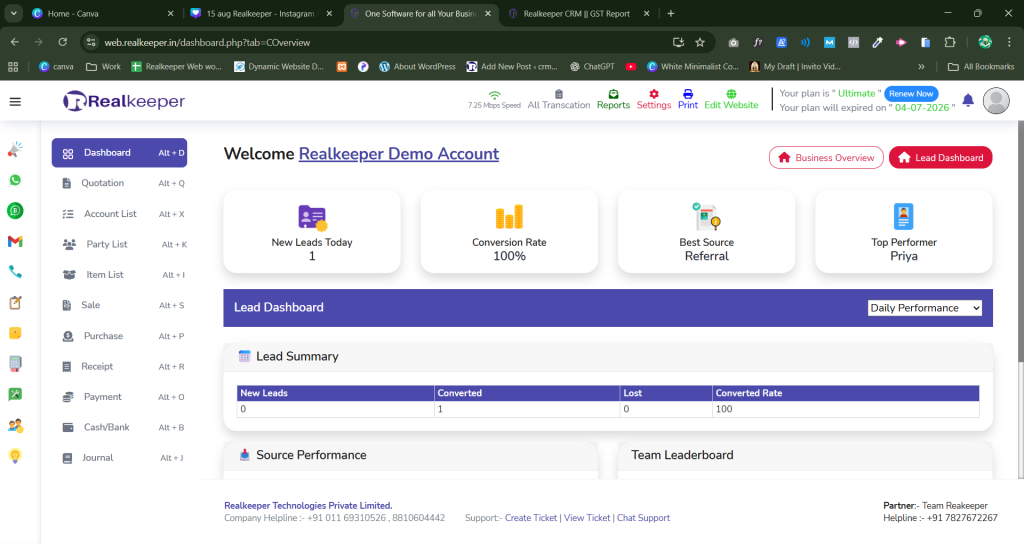

For small businesses in India, a solution like RealKeeper Accounting Software has become a true secret weapon—helping them simplify GST billing, manage accounts efficiently, and gain total financial control.

In this blog, we’ll explore why smart GST billing and accounting software is crucial for small businesses in 2025, the common challenges it solves, and how it can fuel growth in a competitive market.

The Growing Challenges for Small Businesses in 2025

Small businesses are the backbone of the Indian economy, but they face multiple hurdles:

- Complex GST Compliance – Constant GST updates and filing deadlines make manual work stressful. Even small errors can result in penalties.

- Unorganized Billing & Invoices – Many businesses still rely on handwritten or Excel-based invoices, which often lead to mismatches and confusion.

- Cash Flow Issues – Without clear financial records, tracking payments, receivables, and expenses becomes difficult.

- Lack of Real-Time Financial Insights – Entrepreneurs need quick access to profit-loss reports, tax summaries, and stock status to make smarter decisions.

- Time Wasted on Manual Accounting – Instead of focusing on growth, business owners spend hours on bookkeeping and reconciliations.

Clearly, the need of the hour is a digital solution that combines GST billing and accounting in one place.

What is Smart GST Billing & Accounting Software?

Smart GST Billing & Accounting Software is more than just a billing tool. It is an all-in-one solution that:

- Generates GST-compliant invoices in seconds.

- Automates tax calculations to reduce errors.

- Maintains digital records of all transactions.

- Provides instant financial reports for better decision-making.

- Manages inventory, payments, and expenses seamlessly.

This means small businesses no longer have to juggle between multiple tools or worry about compliance—everything is handled under one software.

Why 2025 is the Right Time to Go Digital

The shift to smart accounting isn’t just a trend—it’s becoming a necessity. Here’s why 2025 is the best time for small businesses to adopt GST billing and accounting software:

- Digital India Push – Government policies are encouraging businesses to adopt digital platforms for compliance and transparency.

- Increased GST Regulations – Regular updates in GST laws demand accuracy and real-time adjustments, which are nearly impossible with manual methods.

- Rise of Competition – Businesses that adapt technology stay ahead by offering faster services and better customer experience.

- Remote Access & Cloud Storage – Owners can now manage accounts from anywhere, reducing dependency on accountants.

Key Benefits of Smart GST Billing & Accounting Software

1. Hassle-Free GST Billing

No more confusion over GST rates. The software automatically applies correct GST percentages and generates invoices that meet compliance standards.

2. Time-Saving Automation

Repetitive tasks like tax calculations, payment reminders, and expense tracking are automated, freeing up hours for business growth activities.

3. Accurate Financial Records

Every transaction is digitally stored and easy to retrieve. This reduces errors, avoids data loss, and ensures smooth audits.

4. Better Cash Flow Management

Smart accounting helps track receivables and payables in real time, so business owners always know where their money is going.

5. Inventory & Stock Control

For product-based businesses, inventory tracking is crucial. Integrated accounting software keeps stock levels updated and prevents over-purchasing or shortages.

6. Easy GST Filing

Instead of spending hours collecting invoices, business owners can file GST returns quickly with accurate, pre-recorded data.

7. Cost-Effective Solution

Hiring multiple accountants or using different tools can be expensive. A single accounting software like RealKeeper does it all at a fraction of the cost.

Real-Life Example

Let’s say a small manufacturing business in Jaipur was struggling with manual billing and frequent GST errors. After switching to RealKeeper, they:

- Reduced invoice preparation time by 70%.

- Filed GST returns without last-minute stress.

- Identified unnecessary expenses through financial reports.

- Improved cash flow by tracking late payments automatically.

Within six months, their overall financial management became smoother, and they saved valuable time and money.

Why RealKeeper is the Perfect Choice for Small Businesses

While there are many accounting tools in the market, RealKeeper stands out for small businesses in India because:

- User-Friendly Interface – No advanced accounting knowledge required.

- 100% GST-Compliant – Always updated with the latest rules.

- All-in-One Platform – Billing, accounting, inventory, and reporting under one software.

- Secure & Reliable – Data stored safely with backup options.

- Affordable Pricing – Tailored for small business budgets.

How to Choose the Right Accounting Software in 2025

If you’re planning to adopt GST billing and accounting software, keep these points in mind:

- Compliance – Ensure it meets all GST requirements.

- Ease of Use – It should be simple enough for you or your staff to use daily.

- Integration – Look for software that combines billing, accounting, and inventory.

- Support – Choose a provider that offers strong customer support.

- Scalability – As your business grows, the software should be able to handle more data and transactions.

RealKeeper checks all these boxes, making it an ideal partner for small businesses in 2025.

The Future of Small Business Accounting

In the coming years, we will see:

- More digital compliance requirements by the government.

- Faster GST filing processes with pre-filled forms.

- Cloud-based accounting becoming the standard for accessibility and security.

- Greater focus on data insights, helping small businesses make informed decisions.

By adopting a solution like RealKeeper today, small businesses can future-proof their accounting and stay ahead of competitors.

Final Thoughts

In 2025, Smart GST Billing & Accounting Software isn’t a luxury—it’s a necessity for small businesses that want to grow and stay compliant. Manual methods simply can’t keep up with today’s fast-moving business environment.

With features like automated GST billing, error-free accounting, real-time financial insights, and seamless inventory management, RealKeeper Accounting Software is truly the secret weapon for small businesses in India.

So, if you’re ready to reduce financial stress, save time, and focus on what really matters—growing your business—it’s time to make the smart switch.